When traveling abroad, which is the better way of getting foreign currency: exchanging money or withdrawing from ATM? Is it better to exchange before the trip or in the destination? Should I convert to US dollars first or is it better to convert directly?

These are just some of the questions we frequently receive from our readers. Unfortunately, I don’t have clear-cut blanket answers to these because, as much as I hate answering questions with “It depends,” it really depends on a lot of factors.

It depends on your destination, their policies, and how commonly accepted your home currency is in that country. It depends on your bank, its charges, its exchange rates and its compatibility with financial institutions in your destination. It depends on the availability of these options in your destination. And it depends on the length of your trip.

WHAT'S COVERED IN THIS GUIDE?

What I prefer

But I can tell you what I prefer most of the time:

- For trips shorter than 5 days, if the foreign currency is widely available here — like US dollar, Australian dollar, Japanese yen, Korean won, Hong Kong dollar — we exchange here before the trip. For currencies that are not usually available where I live, we withdraw from the ATM when we reach the destination.

- For longer trips, we I prefer withdrawing cash from the ATM abroad.

We rarely use money changers abroad.

Why withdraw from ATM abroad

Here’s why we usually prefer using the ATM to get cash:

- ATMs usually offer better exchange rates compared to money changers abroad. In our experience, at least. Every now and then, we find money changers with rates that are more favorable than banks, but they are few and far between. Give me a random money changer and a random ATM, and there’s a big chance that the ATM will provide a better rate.

- ATMs are almost everywhere. In most destinations, it’s easier to find a good ATM than a reputable money changer. Most, because there are exceptions. In some islands and remote corners of the world, finding a working ATM can be a challenge. Yep, even in this day and age. But in most cities, ATMs are ubiquitous.

- ATMs are more convenient. Sometimes, even if you find a great money changer, the ATM can still be the wiser choice. Most people don’t realize that unless they’re exchanging a huge amount, the difference is not that big. If you need to ride the train or taxi to get to a good money changer, the fare might be higher than what you thought you had saved.

- I don’t like carrying large sums of cash. An ATM card has an added layer of protection. If your cash gets stolen, that’s it; goodbye, money. But if your ATM card is stolen, you have time to have it blocked and protect your funds.

That said, it is important to use your ATM card strategically. You can’t just withdraw a small amount or whenever you like, as you do at home. Depending on your bank, a fee is often charged PER TRANSACTION.

The key is to withdraw as seldom as possible but without you ending up with a lot of cash on hand. For example, for a 3-day trip, you can just withdraw once. For a 10-day trip, you can withdraw once or twice.

Vins and I often travel together. We don’t make separate transactions when we withdraw money. Only one of us will withdraw cash and divide it between us. Then we’ll settle when we get home. If the trip is long, we usually take turns especially if we’re visiting multiple countries with different currencies. This way, we minimize the number of transactions.

Again, this is not absolute. There are exceptions. There are cases wherein exchanging money makes more sense.

When is it better to exchange money?

Here are some cases wherein I would prefer exchanging currencies instead.

- If you live near a bank or money changer offering good rates and you only need a small amount. This way, you don’t need to worry about it when you’re in your destination. If I live near a Sanry’s or Czarina and my trip is only for a few days, I’ll definitely exchange before the trip.

- If your ATM card is not compatible with ATMs in your destination. Often, having a Mastercard, Visa or Cirrus logo is a great indication. But not all banks have international arrangements set up. If you’re not sure, check with your bank.

- If access to an ATM is limited in your destination. There are islands and remote areas where it’s challenging to find a working ATM, but money changers abound. In this case, it’s best to make sure you have the local currency before you go there. But if you will be jumping off from a city with an ATM, you can withdraw there before heading to your final destination.

- If there are no ATMs at the airport and you need to take public transportation to get to your hotel. Airport rates are bad, so if you’re buying local currency at the airport, just exchange a small amount and just withdraw when you’re in the city center.

- If you know you’ll be making a purchase beyond the withdrawal limit.

Banks usually have a daily withdrawal limit. If you feel like you’ll go over and you need to make this purchase, then the ATM is not your friend this time.

Have a Contingency Fund

For trips longer than a week, even though I plan to withdraw from the ATM, I make sure I bring a small contingency fund in CASH.

You might be asking, if I’m bringing an ATM card with me, why do I still have to bring cash?

It’s because I also want to be prepared in case I run into ATM troubles, which happened to me more than a few times before. It’s best to have extra cash in case of the following:

- Your card gets stolen.

- You misplace your card.

- Your bank blocks your card.

- You reach the withdrawal limit.

- Your card becomes unreadable.

- The machine won’t accept your card.

- You can’t find an ATM.

Hence, I also bring some cash as contingency reserve.

It doesn’t have to be a big amount. I usually just bring 200 USD/EUR. This should be enough to allow me to survive while I figure out a fix to the ATM problem.

I also bring credit cards, just in case.

And make sure that you don’t keep the cash and the cards in the same place.

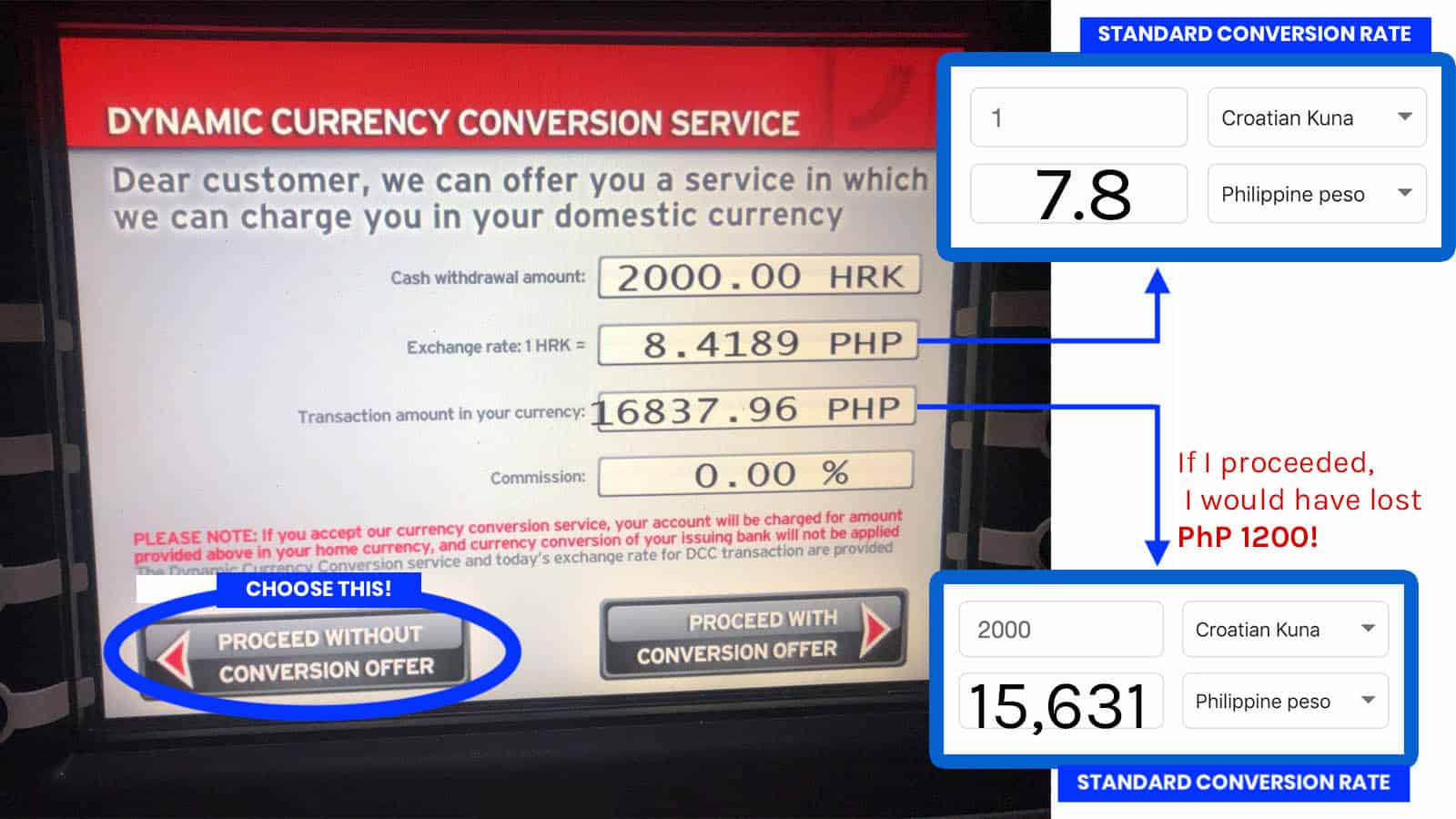

ATM Scam: Dynamic Currency Conversion

Some ATMs will offer you what they call “Dynamic Currency Conversion (DCC)“. It’s sometimes called Cardholder Preferred Currency (CPC). Don’t fall for it.

When you withdraw abroad, the ATM will ask you whether or not you want to be billed in your card’s original currency (PHP if your card is from the Philippines) or in the destination’s local currency. If you agree to be billed in your home currency, you’re letting them set their own exchange rate. This is where they will rip you off because they will use a bad exchange rate and sometimes add a markup or foreign transaction admin fees.

So what should you do? Always select the destination’s local currency.

- If you’re in Thailand and the machine asks, “Would you like to be billed in BAHT or in your card’s home currency?” Choose BAHT.

- In Korea, if the machine asks, “Would you like to be billed in WON or in your card’s home currency?” Choose WON.

- In Singapore, if the machine asks, “Would you like to be billed in SGD or in your card’s home currency?” Choose SGD.

Always decline the dynamic conversion. Always choose to be billed in the destination’s local currency.

✅ READ MORE: WHY DECLINE DYNAMIC CONVERSION?

Money Changer Scams

First of all: Do not make any transaction with a random stranger! They may be exchanging fake money.

Instead, find a reputable company that offers good rates. There are a lot of honest money changers but there are also a lot of rotten ones who will try to rip you off.

Some shops display your currency and the SELLING RATE, not the BUYING RATE. If you want to get local currency, you should be looking at the BUYING RATE. For example, if you’re in Poland but you’re carrying EURO and you want to exchange it to zloty, you’re probably gonna notice money changers with displays that read, “WE SELL: EURO = 4.50.”

Looks like a great deal! The thing is, you’re looking at the wrong rate because what it says is that they will SELL you their euro for 4.50 zloty. What you need is the BUYING RATE because they will be buying your euro.

Cash vs Credit Card

Is it better to pay cash or with a credit card?

That depends on the country or city you will visit. In some destinations in Europe (like Iceland and Sweden), credit card is the more preferred method of payment even at street stalls. In most areas, both are common. In some, cash is still king.

To be honest, our credit card’s spending limit isn’t that big, so we reserve the it for online transactions, especially when booking flights and hotels. More often, we pay cash.

Regardless, we always bring a credit card when we travel because some hotels would ask for it upon check in. Otherwise, you might be forced to make a cash deposit.

Once again, if you’re using your card and you’re asked if you want to be billed in the local currency or the home currency, make sure you choose the local currency. This is dynamic conversion at play.

Other Frequently Asked Questions

When is the better time to exchange money: before the trip or when you arrive in the destination?

Again, that depends on the destination.

For example, in Singapore, I don’t mind using money changers. Most change establishments accept the Philippine peso and I know places that offer good rates.

But I wouldn’t do that in Cambodia or Laos, where it’s very hard to find establishments that accept the peso at a good rate. In these countries, I’ll definitely use the ATM.

In Bangkok, I’m okay either way. If I know I will have time to go SuperRich money changer, I probably won’t bother exchanging here in Manila. But if I don’t have time, I’ll convert here in Manila or just withdraw from ATM in Bangkok.

Is it better to convert my money to USD first than to exchange directly?

Yet again, that depends on the destination.

Usually, I try to convert directly to avoid double conversion fees. But there are countries where PHP, my home currency, is not widely accepted at money changers. There are a lot of countries like that: Laos, Cambodia, Myanmar, Turkey, Kazakhstan, Morocco, the Maldives, just to name a few.

In this case, I will be exchanging my money to USD first (or EUR if traveling to Europe).

But then again, I probably would choose to just withdraw from the ATM if that is an option.

2️⃣0️⃣1️⃣9️⃣ • 1️⃣1️⃣ • 1️⃣6️⃣

Hi! Have you tried ATMs on the arrival gates of Incheon Airport or do you prefer to exchange cash instead in Seoul?

I plan to use my BPI debit MasterCard in Seoul. Is it difficult to use?

Thank much for a wonderful and helpful info. It is informative. More and more power.

Some comments on currency conversion. Although it is true that an ATM will usually give you a better conversion rate, this is offset by the fact that you will be charged an ATM fee by both your own bank and the ATM bank. An addition, you will be charged a “foreign transaction fee” even if you use your ATM card to withdraw from your own account. While I am not sure that every single bank in the world charges these fees, I note that the ten largest banks in America do. I have always found the ATM fees plus the foreign transaction fees were enough to negate any savings on the exchange rate.