For us, withdrawing from an ATM is the most convenient way of getting cash abroad. In many destinations around the world, these money machines are everywhere. It’s also a lot safer than carrying huge sums of money with you or dealing with money changers.

However, withdrawing money abroad isn’t quite the same as doing it at home. If you’re not careful or thoughtful about it, you might end up losing money. So here are seven useful tips that will allow you to maximize each transaction and avoid unnecessary hiccups.

1. DO create a travel account.

This is something I planned a long time ago. When I realized I would be traveling A LOT, I decided to set up a travel account.

What is a “travel account”? Basically, it’s a separate ATM account that I use when I travel. I have at least two bank accounts: one where I put my savings, which we shall call “Savings Account” and the other is where I put money that I will spend when traveling, which we shall call “Travel Account.”

There are many benefits of having these two accounts. The Savings Account is a passbook account where my life savings are. This is also where my salary goes every payday. This is also what I use when applying for a visa.

The Travel Account is what I use when I travel. It doesn’t have as much funds. But before every trip, I just usually transfer money from the Savings Account to the Travel Account. Here’s why:

- If you lose your ATM card or the account gets compromised, you’re not putting your savings in danger.

- Having a separate bank account for travel gives you more control of your expenses during the trip. It allows you to watch your spending more closely. For example, if you have a P50,000 budget for a trip, every time you withdraw cash, you’ll be reminded how much money you have left for this trip. It’s more psychological. It’s like playing mind games with myself, hahaha. But it works for me.

I only bring my Travel Account’s ATM card when I travel. If your Savings Account has an ATM card too, keep it somewhere safe.

2. DO call your bank before the trip.

Once upon a time, I failed to inform my bank that I would be traveling to Greece. It was a dream trip for me. I was really excited. When I landed at Athens airport, the first thing I did was try to withdraw cash. And just like that, my ATM card was blocked. Thank God I was traveling with Vins at the time. He shouldered all my expenses until I had it sorted out.

If you plan on using your ATM card abroad, it is important to let your bank know. Without filing an advisory, the bank will think that you’re still in your home country and that your transactions abroad are suspicious, which can lead to a deactivation of your card.

3. DON’T use non-bank ATMs.

If you’ve been to Europe, you might have noticed a lot of non-bank ATMs or bankomat everywhere. Like, EVERYWHERE. In every airport we landed at, in every tourist spot we visit. And it’s sad because they rip off unsuspecting tourists.

Many non-bank cash machines allow you to withdraw money conveniently, yes, but at a horrible rate. We tried it a couple of times when we first traveled to Europe and we never made that mistake again.

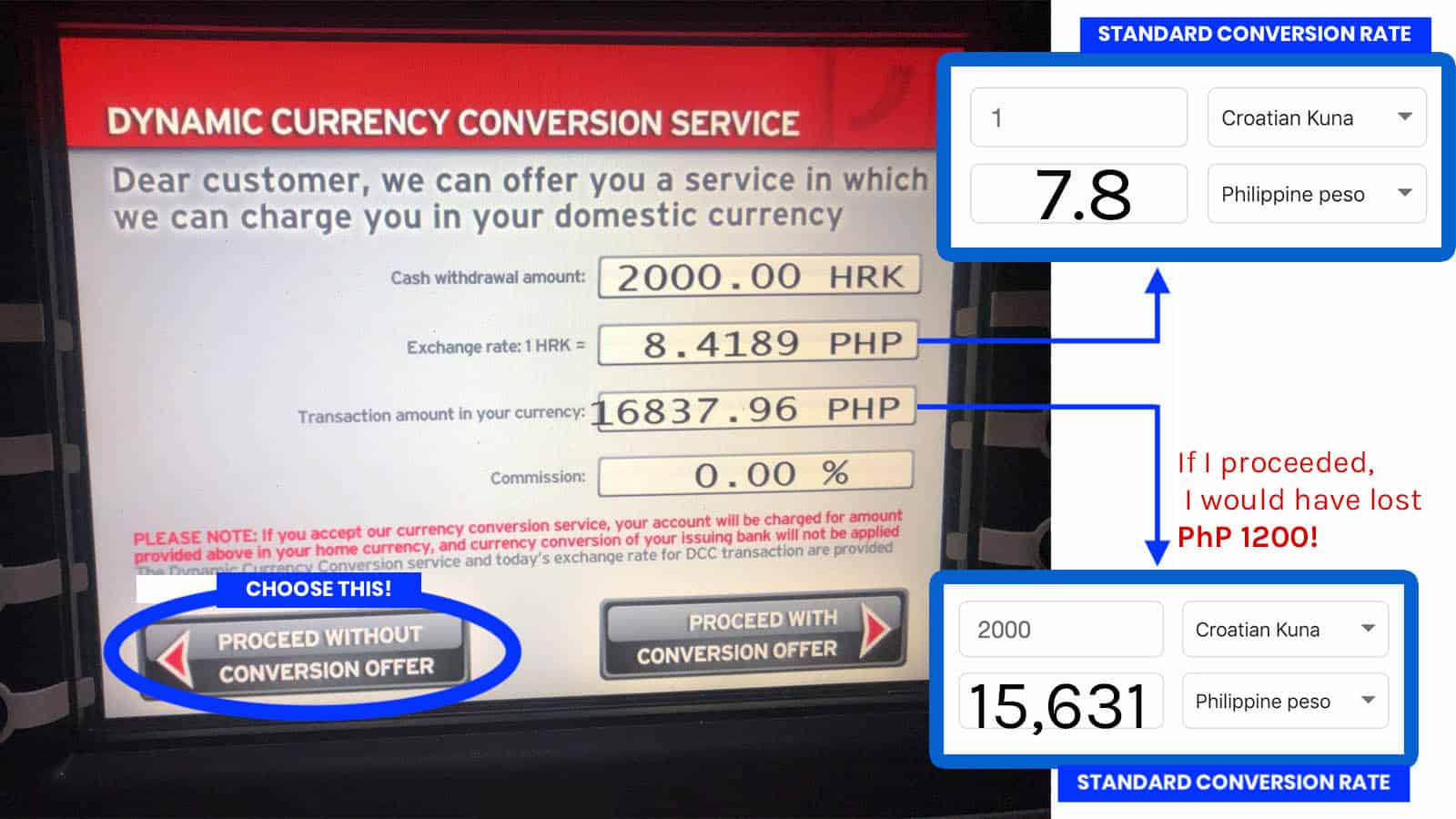

4. DON’T accept the Dynamic Currency Conversion

Some ATMs will offer you what they call “Dynamic Currency Conversion (DCC)“. It’s sometimes called Cardholder Preferred Currency (CPC). Don’t fall for it.

When you withdraw abroad, the ATM will ask you whether or not you want to be billed in your card’s original currency (PHP if your card is from the Philippines) or in the destination’s local currency. If you agree to be billed in your home currency, you’re letting them set their own exchange rate. This is where they will rip you off because they will use a bad exchange rate and sometimes add a markup or foreign transaction admin fees.

This is perfectly legal, but it sure feels like a scam!

So what should you do? Always select the destination’s local currency.

- If you’re in Thailand and the machine asks, “Would you like to be billed in BAHT or in your card’s home currency?” Choose BAHT.

- In Korea, if the machine asks, “Would you like to be billed in WON or in your card’s home currency?” Choose WON.

- In Singapore, if the machine asks, “Would you like to be billed in SGD or in your card’s home currency?” Choose SGD.

Always decline the dynamic conversion. Always choose to be billed in the destination’s local currency.

✅ READ MORE: WHY DECLINE DYNAMIC CONVERSION?

5. DON’T withdraw frequently.

You can’t just withdraw a small amount or whenever you like, as you do at home. Depending on your bank, a fee is often charged PER TRANSACTION.

The key is to withdraw as seldom as possible but without you ending up with a lot of cash on hand. For example, for a 3-day trip, you can just withdraw once. For a 10-day trip, you can withdraw once or twice.

Vins and I often travel together. We don’t make separate transactions when we withdraw money. Only one of us will withdraw cash and divide it between us. Then we’ll settle when we get home. If the trip is long, we usually take turns especially if we’re visiting multiple countries with different currencies. This way, we minimize the number of transactions.

6. DON’T use an ATM in sketchy locations.

If you can find an ATM within the bank premises or inside a safe establishment, that’s ideal. If not, at least choose a machine that is NOT in a dark, secluded place. Scan your surroundings before you begin your transaction. If you notice someone suspicious lurking or loitering around the ATM, go find another.

Skimming is also a problem in some countries. Skimming is the act of installing a fake device in lieu of the real card reader. When you insert your card to the fake reader, it will collect your PIN and other data and they will be able to take control of your money.

Double check the card-reader or the keypad first before inserting your card to any machine.

7. DO have a contingency fund.

Even if you plan to withdraw money in your destination, it’s still a good idea to bring some cash just in case something happens.

You might want to be prepared in case you encounter problems with your ATM, which can be any of the following:

- You lose your card or it gets stolen.

- Your bank blocks your card.

- You reach the withdrawal limit.

- Your card becomes unreadable.

- The machine won’t accept your card.

- You can’t find an ATM.

It doesn’t have to be a big amount. I usually just bring 200 USD/EUR. Having a contingency reserve will allow you to survive while you sort out your ATM issues.

I also bring credit cards, just in case.

If you choose to bring a contingency fund, make sure you don’t store it in the same place where you keep your cards!

2️⃣0️⃣1️⃣9️⃣ • 1️⃣1️⃣ • 1️⃣7️⃣

Hi Yosh, great article! also wanted to share another way of saving atm fees abroad – i use this app called ATM Fee Saver – it helps find the fee-free or lower fee ATMs abroad in many countries, i used it in 4-5 countries and saved a lot of money. got pointed to atms that i never thought would be free. also shows withdrawal limits and all. you should try it out and add it to the article, will be super helpful for international travellers like me!!

Thanks for this, Jess! Very helpful. In my recent Europe trip, I found out that some local banks don’t apply a transaction fee, so yes, this could help.